Why do companies use derivative instruments. Employ derivatives to transfer risk but never succumb to the temptation to trade in risk for its own sake.

Foreign Exchange Risks.

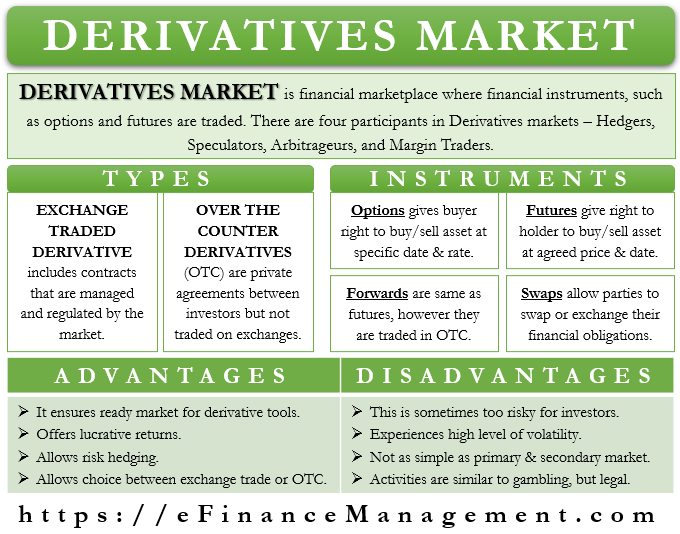

Why do companies use derivative instruments. Financial Derivatives are widely used by corporations to adjust to exposure to currency risk interest rate risks commodity price risks and security holdings risk. A simple rule of thumb can help managers distinguish between hedging and speculation. In essence a derivative constitutes a bet that something will increase or decrease.

In the former case derivatives are used to offset expected changes in the value of an asset or liability so that the net effect is zero. What are the differences between traditional and derivative instruments. Explain whether or not derivatives are a good investment.

As such a derivative can be used in two ways. One reason firms use derivative instruments is to reduce these financial constraints and to ease the financial distress of the company. The owners of the company might ask why you have not paid the lower energy prices.

- Answered by a verified Tutor. Sunday August 5 2012. Explain whether or not derivatives are a good investment.

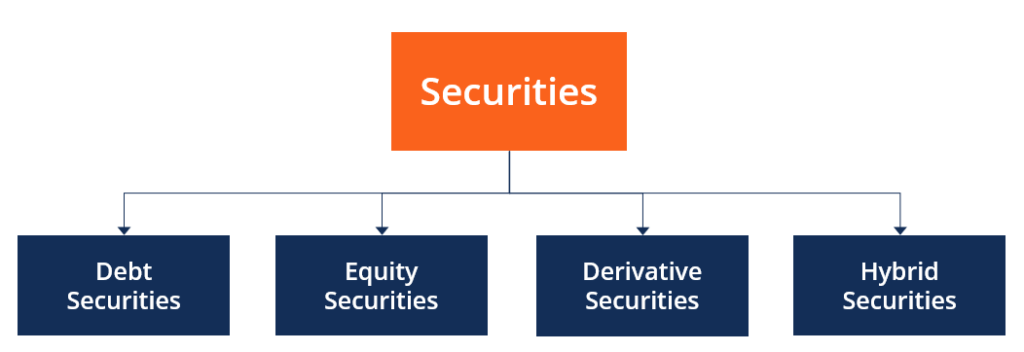

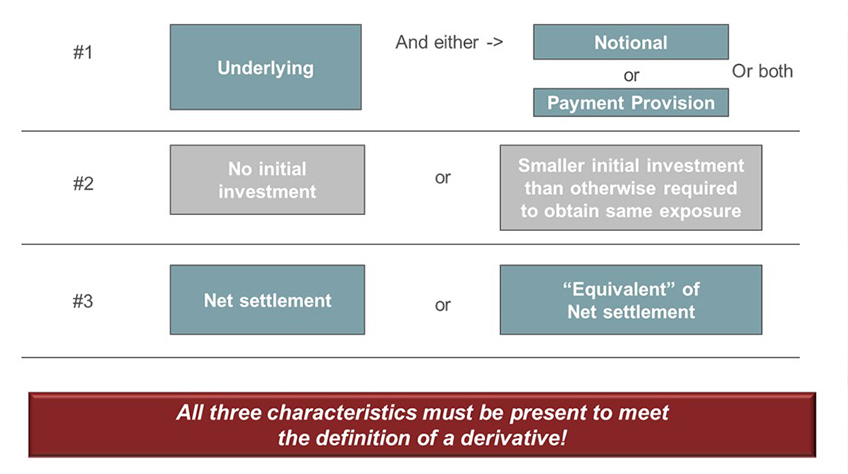

A derivative financial instrument is different as it must have three characteristics. A swaption is an example of derivative instrument an insurer could use to mitigate the risk arising from these typical interest rate guarantees. Are derivatives a good investment.

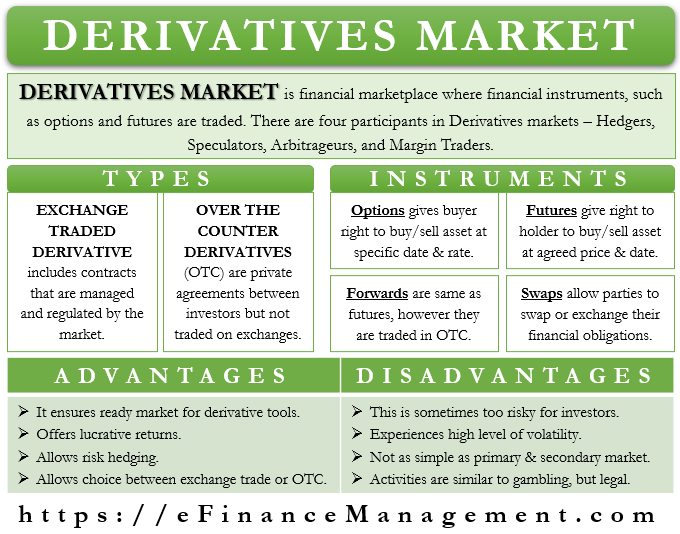

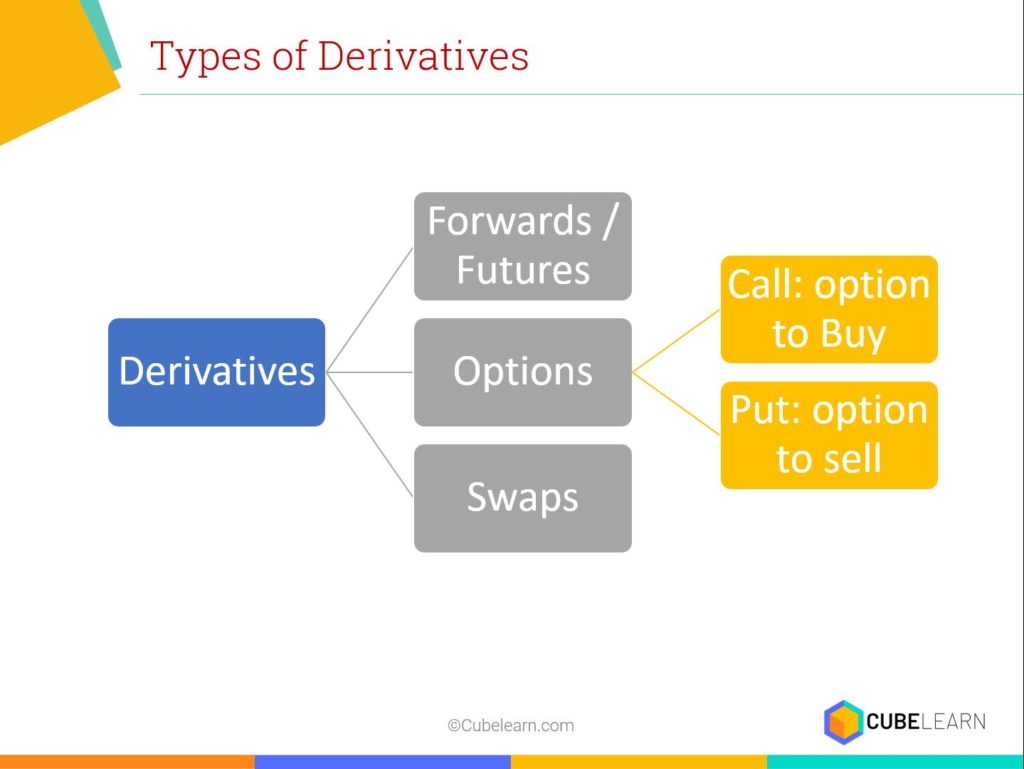

Rajesh Kumar in Strategies of Banks and Other Financial Institutions 2014. Why do companies make investments in other companies. Derivatives are financial instruments that have values tied to other assets like stocks bonds or futures.

Up to 20 cash back Why do companies use derivative instruments. The financial device that Aristotles story described was in fact a derivativepossibly the first recorded derivative trade. Derivatives Use by Public Companies A Primer and Review of Key Issues.

Derivatives are also used to expose hedge to fluctuations in interest rate managing foreign currency exchange rates and for investing in commodities. An underlying is a specified interest rate security price commodity price index of prices or rates or other market-related variable. Either it is a tool for avoiding risk or it is used to speculate.

Suppose you are a purchasing manager in an energy company. They are used to manage a wide variety of risks. The instrument has a one or more underlyings and b an identified payment provision.

Basically hedging consists of taking a risk position that is opposite to an actual. Hedging is a type of investment strategy intended to protect a position from losses. Derivative instruments are used by companies to protect themselves from business risks.

This paper explains what derivatives are why they matter how derivatives are used to manage commercial and investment risks some of the dangers of derivatives and reviews two important reforms put in place. We use cookies to give you the best possible experience on our website. In general derivatives contracts promise to deliver underlying products at some time in the future or give the right to buy or sell them in the future.

One reason firms use derivative instruments is to reduce these financial constraints and to ease the financial distress of the company. Derivatives can be a good investment if the price goes up and there is able to be a gain on investment at the time the asset is. 52842 Hedging with derivatives.

Why do companies use derivative instruments. Investments based on some underlying assets are known as derivatives. Why do companies use derivative instruments.

What are the differences between traditional and derivative instruments. Intermediate Accounting Please answer each question individually in at least 200 words per question. Explain why or why not.

Largely companies are currently exposed to risks caused by unexpected movements in exchange rates and interest rates. You have probably realised that derivatives can reduce risk but they do not always increase profits. In the latter case an entity.

What experience do you have with either traditional or derivative instruments in your organization or an organization that you are familiar with. You have probably realised that derivatives can reduce risk but they do not always increase profits. Derivative contracts are used in order to be protected from any future changes in interest rates stock prices foreign currencies and such risks.

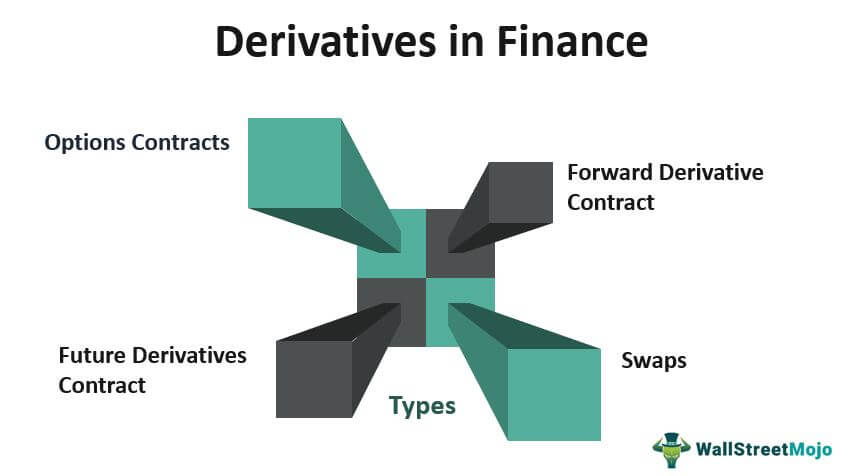

Over the last several decades the use of derivatives as a. Financial institutions and corporations use derivative financial instruments to hedge their exposure to different risks including commodity risks foreign exchange risks and interest rate risks. A derivative is a contract with in two parties the most common are seen as financial forwards or financial futures options and swaps.

How Derivative Instruments are Used. For example a company that owes a large amount of debt at a variable or floating interest rate may prefer to lock in its debt at a fixed rate to insulate itself from an interest-rate hike. What experience do you have with either traditional or derivative instruments in your.

One of the more common corporate uses of derivatives is for hedging foreign currency risk or foreign exchange risk which is the risk a change in currency exchange rates. By continuing to use this site you consent to the use of cookies on your device as described in our. Derivatives are complex financial instruments that derive their value from an underlying instrument or asset such as a commodity or a currency.

Derivatives Market Types Features Participants And More

What Are Derivative Instruments Times Of India

Types Of Security Overview Examples How They Work

Interest Rate Swap Derivative Pricing In Excel Interest Rate Swap Interest Rates Financial Services

Advanced Financial Accounting Chapter 9 Ppt Download

What Are The Different Products Of Cryptocurrency Derivatives Cryptocurrency Crypto Currencies Derivative

What Is Capitalization Ratio In 2020 Budgeting Tools Personal Financial Advisor How To Get Money

Reasons For The Use Of Derivatives Cubelearn

What Is Hedge Accounting Budgeting Budgeting Money Money Management

Identifying And Accounting For Embedded Derivatives Under Asc 815 Gaap Dynamics

Types Of Trade Finance Instruments Trade Finance Finance Trading

Solved Understanding Derivative Instruments 1 What Is Chegg Com

Derivatives And Hedge Accounting An Overview Of Asc 815 Gaap Dynamics

Introduction To Derivatives Market

Derivatives In Finance Definition Uses Pros Cons

:max_bytes(150000):strip_icc()/dotdash_Final_Equity_Derivative_Aug_2020-01-8b165b177a3a4a06951b2c33dede9f8a.jpg)

/dotdash_Final_Equity_Derivative_Aug_2020-01-8b165b177a3a4a06951b2c33dede9f8a.jpg)

/derivative.finalJPEG-5c8982d646e0fb00010f11c9.jpg)

:max_bytes(150000):strip_icc()/derivatives__shutterstock_398835340-5bfc2f1ac9e77c0051449058.jpg)

:max_bytes(150000):strip_icc()/derivative.finalJPEG-5c8982d646e0fb00010f11c9.jpg)