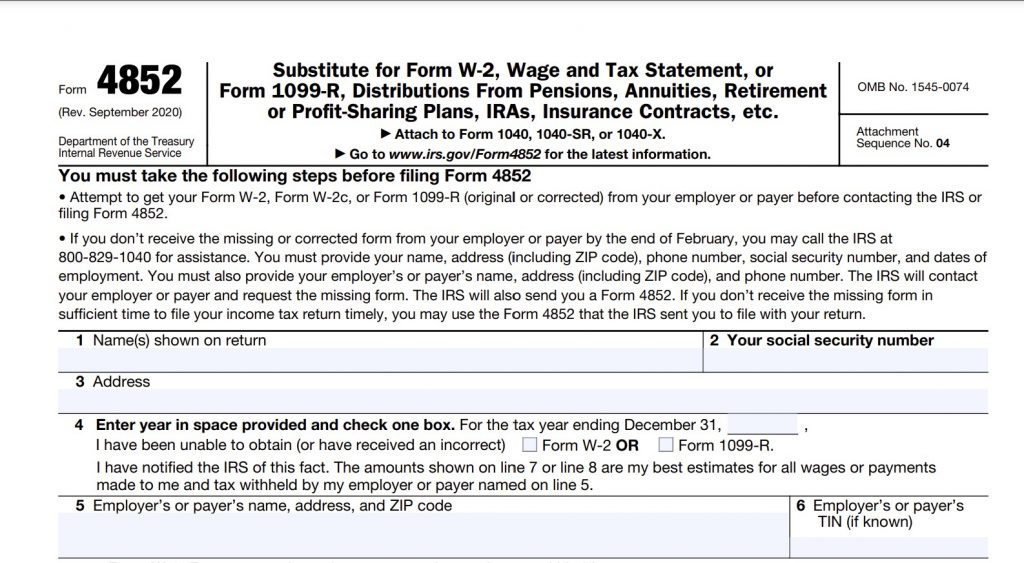

Your tax return is normally due on or before April 18 2016. If even after nudging from the IRS your employer doesnt send you a replacement W-2 in time for you to file your tax return you may file using Form 4852 in place of your missing wage statement.

Didn T Get A W 2 Tax Form Here S What To Do Fox Business

You can report gambling losses on Schedule A as a way to reduce your tax.

Why didn t i receive my w2. The IRS requires US. They dont even need your W2 to steal your tax refund. Ask when and where the form was mailed.

A blue-ribbon commission in Congress was set up to design a more flagrantly moronic system but it failed to find one. The IRS takes this issue very seriously and does not hesitate to assess hefty interest and penalties to folks who dont comply. CDOR requires that the SSN be revealed in full on the W-2 so that our systems can process the information.

If youve separated within 13 months you can login to your myPay account to get your W2. If it was mailed it may have been returned to your employer because of an incorrect or incomplete address. It is important to keep an accurate diary or similar record of your gambling winnings and losses.

The W2 online import solution means that you can get a copy of your W2 with HR Block or TurboTax and they will start the process to get you your refund as quickly. Your name address Social Security number and phone number. Estimate your wages and taxes withheld as best as you can.

Tax Liabilities Penalties and Interest Oh My. Masked or truncated W-2 forms will not be processed. Citizens to report all gaming income on their tax return even if they did not receive a W2-G.

The IRS will reclassify all 1099-MISC payments made to S Corp owners as W-2 wages. If you receive your W-2 after filing and the information you provided on your Form 4852 was inaccurate you will need to correct it using a Form. The pay stub should show the employer name address.

If your employer refuses to send one find your last pay stub. Waiting for a tax refund is frustrating and if you receive your W2 document late in the game that wait could be long. The W2 contains your social security number which for some idiotic reason appears to be the key that opens a whole lot of doors.

If you havent received your W-2 follow these four steps. If you do not receive your W-2. If they mailed you a notice call the number listed and have a copy of your tax return along with the Form W-2 handy so you can help them resolve your problem.

Use Form 4852 Substitute for Form W-2 Wage and Tax Statement if you dont get your W-2 in time to file. Filing taxes after youve separated. If you have not received your Form W-2 by the due date and have completed steps 1 and 2 you may use Form 4852 Substitute for Form W-2 Wage and Tax Statement.

However the amount of losses you deduct may not be more than the amount of gambling income you have reported on your return. If you cant access your myPay account you can submit a tax statement request via askDFAS and well mail you a hard copy. If you have not received your Form W-2 or Form 1099 please contact your employer to learn if and when the W-2 was delivered.

In the Less Common Income section click on the StartUpdate box next to gambling winnings. If you cant get it done. Maybe it got caught in a machine and they will find it when they do periodic maintenance.

Attach Form 4852 to the return estimating income and withholding taxes as accurately as possible. If youre unable to get your Form W-2 from your employer contact the Internal Revenue Service at 800-TAX-1040. Claim your gambling losses as a miscellaneous deduction on Form 1040 Schedule A PDF.

On the next screen Any Other Gambling Winnings click the Yes box. If you did not receive. Maybe it got lost in the mail.

If you still havent received your W-2 follow these steps. Youll need the information shown there to recreate your missing W-2 and to notify the IRS that your employer did not send a W-2. Contact your employer If you have not received your W-2 contact your employer to inquire if and when the W-2 was mailed.

The USPS provides excellent service but they handle billions of pieces of mail and sometimes something goes astray. If the address is incorrect ask them to resend it. If it was mailed it may have been returned to the employer because of an incorrect or incomplete address.

Maybe your employer didnt send it. On the Gambling Winnings screen click the Yes box. On the screen Tell Us About Your Winnings click the Skip W2-G box if Form W2g is not issued.

The IRS will contact your employer or payer and request the missing form. The Colorado Department of Revenue CDOR is aware of the recent IRS change to allow for the masking or truncation of part of the Social Security Number SSN on the federal W-2 form.

Replacing A Missing W 2 Form H R Block

Didn T Get Your W2 Here S What To Do Now The Motley Fool

3 Ways To Request A Duplicate W 2 Wikihow

Fafsa Checklist Fafsa Checklist Create Yourself

Haven T Received A W 2 Form Here S How You Can Still File Your Taxes Masslive Com

Cat Eye Glasses Cat Eye Glasses Cat Eye Glasses Frames Eye Glasses

What To Do If You Haven T Received A W 2 Turbotax Tax Tips Videos

Missing A W2 Follow These 3 Easy Steps To File A Tax Return

What To Do If You Haven T Received Form W 2 Taxact Blog

Haven T Received Your W 2 Take These Steps

This Looks Like Some Type Of Collage And It S Just Fascinating Might Be A Fun Project For My Da Collage Art Projects Cool Art Projects Art Journal Inspiration

Lost W2 No Problem Lost W2 Help Community Tax Community Tax

Hubley S Bar M Leather Double Holster Belt W 2 Hubley 38 Toy Cap Pistols Cap Pistol Holster Vintage Cap

W 2 Biggest Comment I Got Was Weren T You An Artist Or Something Did That Work Out I Told Them It Eventually Did Asl Clutched The Keys To My Datsun S

This Week S Challenge Proved To Be A Breath Of Fresh Air We Concentrated On One Tangle Maria Thomas W2 And Tangle Art Zentangle Patterns Tangle Patterns

Katsaridaphobia Word Nerd Fear Creative Writing

Didn T I Wear These 30 Years Ago And Weren T They Bare Traps Me Too Shoes Women Shoes Crazy Shoes

4 Things To Do If You Don T Get Your W 2 On Time Primepay

Glow In The Dark Camping Bucket Seat In 2021 Glow In The Dark Bucket Light Fun Bucket